In the ever-evolving digital landscape, where cryptocurrencies reign supreme, the symbiotic relationship between mining machine efficiency and profitability stands as a cornerstone for miners and investors alike. Understanding this connection is paramount for navigating the turbulent waters of the crypto market and securing a sustainable and lucrative mining operation. The allure of decentralized finance and the potential for significant returns have fueled a surge in mining activity, but success hinges on a deep understanding of the intricate factors at play.

At its core, cryptocurrency mining is a computationally intensive process that involves verifying and adding new transaction records to a blockchain. Miners deploy specialized hardware, known as mining machines or rigs, to solve complex cryptographic puzzles. The first miner to solve a puzzle receives a reward in the form of newly minted cryptocurrency. This process not only validates transactions but also secures the network against malicious attacks.

The efficiency of a mining machine is directly proportional to its ability to generate revenue. Measured in terms of hash rate per unit of power consumed (e.g., TH/s per watt), efficiency determines how quickly a machine can solve these cryptographic puzzles and earn rewards. A more efficient machine can perform more calculations with less energy, leading to higher profitability. Conversely, an inefficient machine consumes more power while producing fewer results, eroding profit margins and potentially leading to financial losses.

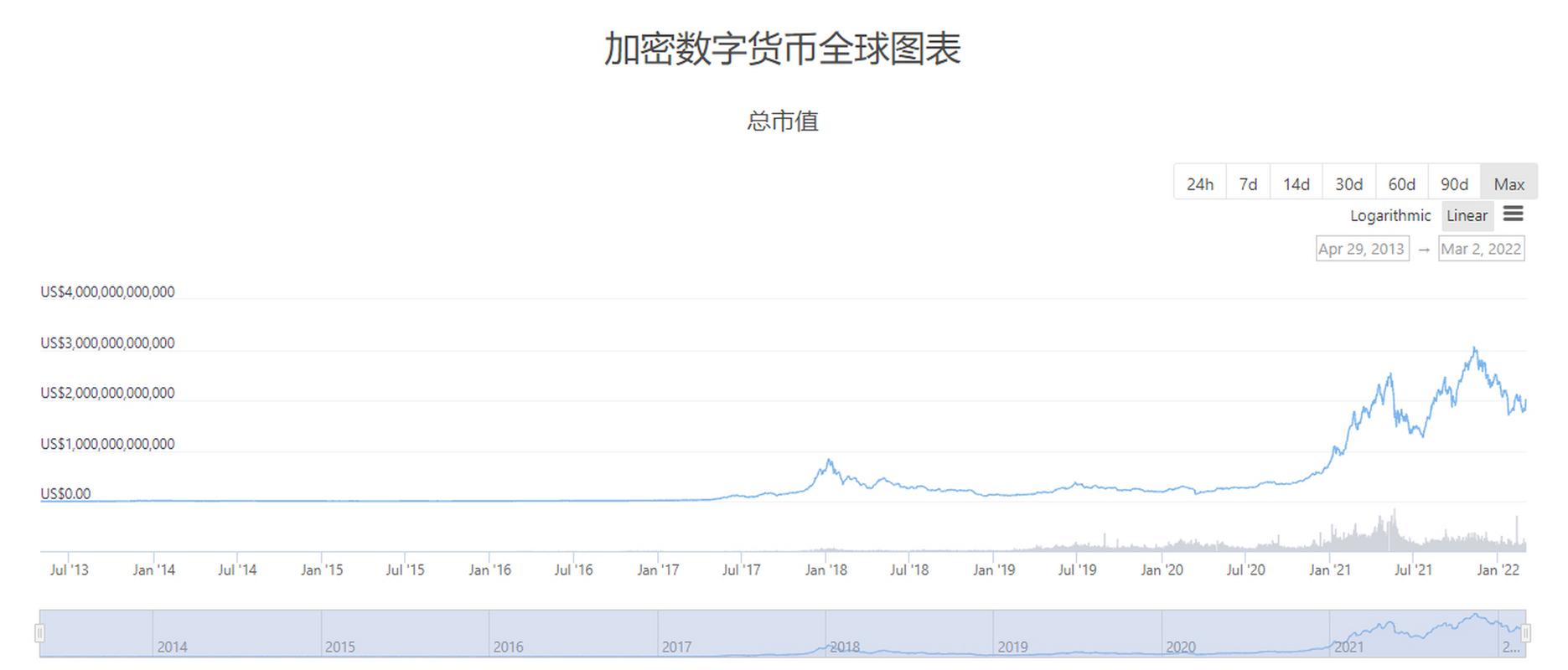

The profitability equation is further complicated by several external factors. The price of the cryptocurrency being mined is perhaps the most significant determinant of profitability. Fluctuations in market value can dramatically impact the returns generated by mining. A sudden price drop can render previously profitable mining operations unprofitable, especially if operating costs are high. This inherent volatility necessitates a prudent and adaptable approach to mining.

Another crucial factor is the difficulty of the mining algorithm. As more miners join the network, the difficulty level automatically adjusts to maintain a consistent block creation rate. This adjustment ensures that new blocks are added to the blockchain at regular intervals, regardless of the total computational power participating in the network. As difficulty increases, miners need more computing power to solve the puzzles, which in turn requires more efficient machines or a larger number of less efficient ones.

Electricity costs are a substantial component of mining expenses. Mining operations consume vast amounts of electricity, and the price of electricity can vary considerably depending on location. Miners often seek out regions with low electricity rates to minimize their operating costs. Some innovative miners are even exploring renewable energy sources like solar and wind power to further reduce their environmental footprint and enhance their profitability.

The concept of mining machine hosting has emerged as a popular solution for individuals and businesses looking to participate in cryptocurrency mining without the complexities of managing their own hardware and infrastructure. Hosting providers offer secure, climate-controlled facilities with reliable power and internet connectivity. By outsourcing the technical aspects of mining, customers can focus on maximizing their returns without having to worry about hardware maintenance, cooling, or power management.

The type of cryptocurrency being mined also plays a significant role in determining profitability. Bitcoin, the original cryptocurrency, has the highest difficulty level and requires specialized ASIC (Application-Specific Integrated Circuit) miners. Other cryptocurrencies, such as Ethereum (before its transition to proof-of-stake), were traditionally mined using GPUs (Graphics Processing Units). The specific hardware requirements and mining algorithms vary from one cryptocurrency to another, and miners must carefully consider these factors when choosing which coins to mine.

Beyond Bitcoin and Ethereum, a plethora of alternative cryptocurrencies, often referred to as altcoins, offer varying degrees of mining profitability. Some altcoins have lower difficulty levels and can be mined with less powerful hardware, making them accessible to a wider range of miners. However, the market value and long-term viability of altcoins can be uncertain, so miners must conduct thorough research before investing in altcoin mining.

The rise of decentralized exchanges (DEXs) and centralized exchanges (CEXs) has further complicated the cryptocurrency landscape. These platforms facilitate the trading of various cryptocurrencies and offer miners the opportunity to quickly convert their mining rewards into fiat currency or other digital assets. The liquidity and trading volumes on these exchanges can impact the price of cryptocurrencies and, consequently, the profitability of mining.

In conclusion, the connection between mining machine efficiency and cryptocurrency profitability is multifaceted and dynamic. Miners must carefully consider the efficiency of their hardware, the price of the cryptocurrency being mined, the difficulty of the mining algorithm, electricity costs, and the availability of mining machine hosting services. By staying informed and adapting to the ever-changing crypto market, miners can increase their chances of success and secure a profitable future in the world of decentralized finance. Understanding the nuances of this ecosystem is not just advantageous; it’s essential for survival and prosperity in the digital gold rush.

Leave a Reply to Wax Cancel reply