In the tumultuous waters of the cryptocurrency world, Bitcoin mining holds a pivotal role, transforming computational power into rewards. But with the plethora of mining machines available, how does one master the art of selection? The journey goes beyond just securing hardware; it’s about understanding the nuances that define profitability and efficiency in a mining operation.

Bitcoin, the pioneer of digital currencies, operates on a Proof of Work (PoW) consensus mechanism, meaning miners validate transactions on the blockchain by solving complex mathematical problems. The efficiency and effectiveness of your chosen mining machine directly influence the success of your mining endeavors. For instance, high hash rates and energy efficiency are crucial metrics to consider. Mining machines, often referred to as mining rigs, vary vastly in price and output, necessitating a careful approach to selection.

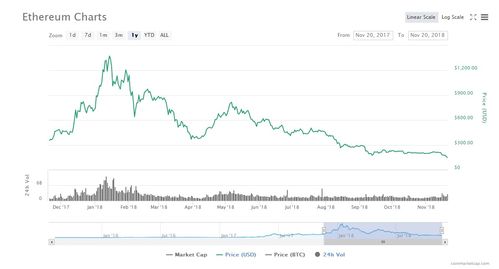

In contrast to Bitcoin mining, which garners the lion’s share of attention, other cryptocurrencies such as Ethereum and Dogecoin offer distinctive advantages. Ethereum’s shift to Proof of Stake (PoS) means that while direct mining becomes obsolete, understanding its mechanism enriches the miner’s knowledge base. Conversely, Dogecoin mining is marked by its accessibility and community-driven aspects. This diversification in focus is paramount for miners looking to expand their portfolio beyond Bitcoin.

When assessing mining machines, one must consider the hardware specifications: GPU vs. ASIC, power consumption, cooling solutions, and the software compatibility with mining pools. Graphics Processing Units (GPUs) provide flexibility and are suitable for a variety of coins, while Application-Specific Integrated Circuits (ASICs) are tailored for specific tasks—Bitcoin, for example. While ASICs might present a higher entry cost, the returns can be exponential if your operation runs efficiently in a well-structured mining farm.

Moreover, hosting solutions emerge as a beacon for potential miners hesitant to establish a physical space. Mining machine hosting services offer the advantage of professional setups, including optimal temperature control, maintenance, and reduced noise pollution. These services allow individuals to rent space within a mining farm while tapping into the expertise of seasoned professionals. This model is particularly appealing as it minimizes the hassle of upkeep and maximizes miners’ potential return on investment.

As you delve deeper into the ecosystem of cryptocurrencies, understanding exchanges’ role becomes paramount. Exchanges facilitate the buying and selling of mined cryptocurrencies, directly affecting your profitability. Navigating exchanges requires keen awareness of market trends and price fluctuations, ultimately influencing the timing of your trades. For miners tapping into the volatile world of crypto, aligning mining efforts with market strategies can lead to enhanced profitability.

The world of blockchain technology also introduces the concept of decentralized finance (DeFi), reshaping traditional finance paradigms. While miners are critical to the network’s security, the rewards they earn can be further leveraged within DeFi platforms, creating additional income streams. By lending or staking Ethereum, for example, miners can augment their earnings beyond mere block rewards.

Engaging with the community through forums and social platforms can enrich your understanding of mining advancements and trading strategies. The rapid evolution of technology often leads to the introduction of novel mining methods and strategies—knowledge sharing within the mining community can lead to the discovery of hidden gems and innovative breakthroughs.

In conclusion, the art of Bitcoin mining machine selection transcends the mere act of purchasing hardware. It requires an insightful approach that includes understanding various cryptocurrencies, engaging with the community, and leveraging mining farms and exchanges. The landscape is vibrant, offering myriad opportunities for those who commit to continuous learning and adaptation. As the cryptocurrency space faces regulatory changes and technological advancements, the miner who masters the art of selection will stand resilient, ready to navigate the tides of this digital gold rush.

Leave a Reply to Suresh Cancel reply